Spotlight on De Beers – the Las Vegas Presentation

Gary Roskin

Roskin Gem News Report

A presentation by De Beers, with Al Cook, Chief Executive Officer, De Beers Group, Richard Lawson, CFO, De Beers Group, and Sandrine Conseiller, CEO, De Beers Brands.

[Simply due to the number of details provided in Al Cook’s insightful presentation, we will postpone the discussion from Lawson and Conseiller to a future date. – gr]

Spotlight on DeBeers – the Las Vegas Presentation

It was opening day of the JCK Las Vegas show. Al Cook, the new De Beers Group chief executive officer, greeted a packed ballroom of mainly diamond wholesalers, including site-holders, some retailers, and a good number of industry notables.

Cook, at the time of this presentation, had been CEO of the De Beers Group for just 15 months. And now he was addressing a room filled with well-informed and concerned industry members. They were concerned about the economy, about falling diamond prices, about Russian sanctions, about the rising market share of synthetic diamonds, and about the sale of De Beers!

Photo Courtesy of De Beers

Tough Crowd

It must have been challenging for Cook to stand in front of this crowd, openly admitting that it took him 15 months to familiarize himself with De Beers and his team. Not only was this presentation important for his shareholders, it was necessary to win the room, that the attendees should set aside their concerns and know that De Beers was going to keep the global diamond industry on track. And he made this presentation all the while having a corporate take-over looming above him. A lot is riding on De Beers. The question is, can they maintain control of the market, and itself?

For the next 15 minutes, Cook proceeded to present the De Beers strategy on all fronts. The presentation began with a video, a short history of a benevolent De Beers, about how important they are to the global diamond industry, and to the world. For the consumer and shareholders, it would have been very impressive. For the members of the diamond industry watching, however, it did nothing to reduce their worries. Cook was the professional, and carried on past the lack-luster applause.

and listening for anything new about De Beers’ LGD business, Tom Chatham (right).

Photo courtesy of De Beers

Cook then posted a classic 5-point CEO list of talking points, created to persuade the audience that De Beers is still the leader:

“We are the world’s largest diamond producer!” he shouted. “We are the world’s most competitive diamond producer! Our portfolio is underpinned by a valuable Botswana partnership! We have a proven track record in driving market growth! And we have a clear pathway to increase profitability!”

Points 1 through 4 were not in question. Point 5 is what the room wants to know. Just how are they going to do that?

And then he showed us all why he is CEO [These are the highlights, including the bombshell closing statement].

Included are several points of discussions, all necessary to tackle a very complicated business. Cook and his team even present a fairly convincing review of their pilot “Origin Story” (and we are not easily swayed on diamond provenance programs).

Let’s Get Serious

In the diamond business, bigger is better. And Cook made that point perfectly clear. “We are the largest diamond producer in the world,” he proudly shouted from eth podium. “Together with our joint venture partners, we produce more than a third of the global supply of diamonds.” It’s all about scale. De Beers is still big. While they may not have a monopoly on the world’s production as they once had, Cook knows they can still affect everything that has to do with the diamond business. And after a troublesome 2023, he knows that De Beers needs to step up its game.

Provenance

Cook dives right into mine to market provenance. But before we give you his comments, let’s make this perfectly clear. We are all aware that diamonds themselves cannot be gemologically traced back to a country of origin as can be done with emeralds, rubies, and sapphires. For diamonds, we rely solely on the honesty of the producer, tied together with block chain record keeping, transferred all the way to the retail counter.

Cook knows that De Beers is big enough, and trusted enough, to be able to make a very compelling case.

Cook continues: “As we recover these stones from stable, ethical countries with a strong track record of high operating standards for diamond production, these provenance credentials will become more and more significant not only due to evolving consumer expectations, but also because the world’s second largest diamond producer by value, the Russian company ALROSA, is now facing a range of international sanctions.”

“But our portfolio is more than just scale or assured provenance,” says Cook. “It’s also about quality.”

He’s Done his Homework

After a brief discussion of the quality/value from De Beers owned and “operated assets,” Cook proves that he knows the century-old De Beers business model. “We can ramp production up… and down,” says Cook. By tracking supply and demand, mining and selling only what the market can absorb, De Beers maintains a steady market.

“The competitiveness of De Beers’ mines will also continue to grow, both given the sanctions currently applied to the Russian production, as well as the expected closures of several third-party mines over the course of the next decade.” They are monitoring the world’s diamond production, its quality and quantity, making sure De Beers stays the leader.

Botswana

Cook spoke of their partnership with Botswana (owning 15% of De Beers). They have a mutual desire for good business. [There will be a forthcoming report in the Roskin Gem News on Botswana as we attended a JCK Las Vegas press conference with the president of Botswana, Mokgweetsi Masisi.]

Demand (De Beers Banking on the Past)

Cook’s presentation was filled with the classic grandiose predictions of better days ahead, with few details as to how all this is going to happen. Cook was also very excited to tell us about their new connection with Signet, the largest jewelry retailer in the world. But again, this did little to boost any confidence in the room (unless, of course, you were with Signet). There was no mention of any intention for international marketing, as had been done in the past. (Or, if there were, it was hidden in corporate speak.)

Consulting Group Results

De Beers hired the Boston Consulting Group (BCG) to determine specific industry numbers, especially numbers that might tell us in which direction we are heading. “We anticipate diamond price growth,” says Cook. “In fact, the world renowned Boston Consulting Group (BCG) has undertaken an in-depth study based on its own research and is projecting growth of 3 to 5% in prices per annum.” Cook eventually gets around to discussing this predicted future of positive growth, and why 2023 was to terrible.

If you are interested, you can find that report here.

The Reduction in Production – We have Passed the Peak

Many of us wonder when the next Argyle, or Diavik will show up. When it comes to how much diamond is left to mine, Cook is not so upbeat. “We are already passed the peak,” warns Cook. “Despite billions of dollars being spent on exploration, there has only been one commercial discovery in the 21st century. That’s extraordinary,” notes Cook. “That was Luele [Luele diamond deposit in Angola].” Angola is De Beers’ latest stomping ground for exploration. They are hoping for more deposits, but not banking on it. “We expect global diamond production to fall by 1% per annum, through 2040.” And what after that?

The good news from this is that mine closures will support price growth. “We will see a dip resulting from the closure of Renard [diamond mine in Canada] and other plants that ceased operating in the last year. Next, we see something of an increase in supply due to Luele in Angola, and our Venetia underground mine [in the Republic of South Africa] as both ramp up before the start [of yet another] decline with the Diavik mine [in Canada], and others cease production.” And by 2028, there will be more closures in Canada, and a reduction in production in Russia. And then through to 2040, a steady decline.

Reality – How Bad Was Last Year?

Cook was straight with the room. “It goes without saying,” but he says it anyway, “you all know that 2023 was an exceptionally bad year for the diamond industry.” This comment from Cook finally worked, coming across as being much more personable and a part of the audience. “But it’s important to understand what led to the situation. And equally worth remembering that 2021 and 2022 saw record all-time highs in terms of demand for natural diamond jewelry. However, in 2023, the success of the preceding years became a burden, as heavily stocked industries met head-on with a significant decline in demand.”

Cook then pointed to high inflation rates that affected disposable income. The Chinese demand kept dropping. And on top of that, there was a lull in demand for engagement rings. “Couples were not falling in love during the pandemic.” And according to Cook, it takes about three years on average for new couples just to get engaged. So, is he saying, “wait until next year…”?

The LGD Conversation

“In 2023, we also saw huge growth in LGD supply at a time when consumers were financially crashing, and that led to increased consideration for lower price products.”

“With all of these issues affecting consumer demand at a time when the pipeline was already fully stocked, the impact on diamond miners [De Beers included] was amplified, creating substantial downward pressure on rough diamond sales.”

Cook believes this is all temporary. “As the global economy improves through the cycle, we will see more people with more disposable income to spend on more diamonds.”

The Positive/Negative Predictions

Looking at the numbers, Cook says that the data shows a 25% increase in US engagements over the next three years. And while LGDs have certainly had an impact “on natural diamonds demand, their price is now collapsing.”

Production Cost, Plus Margin = $100/carat

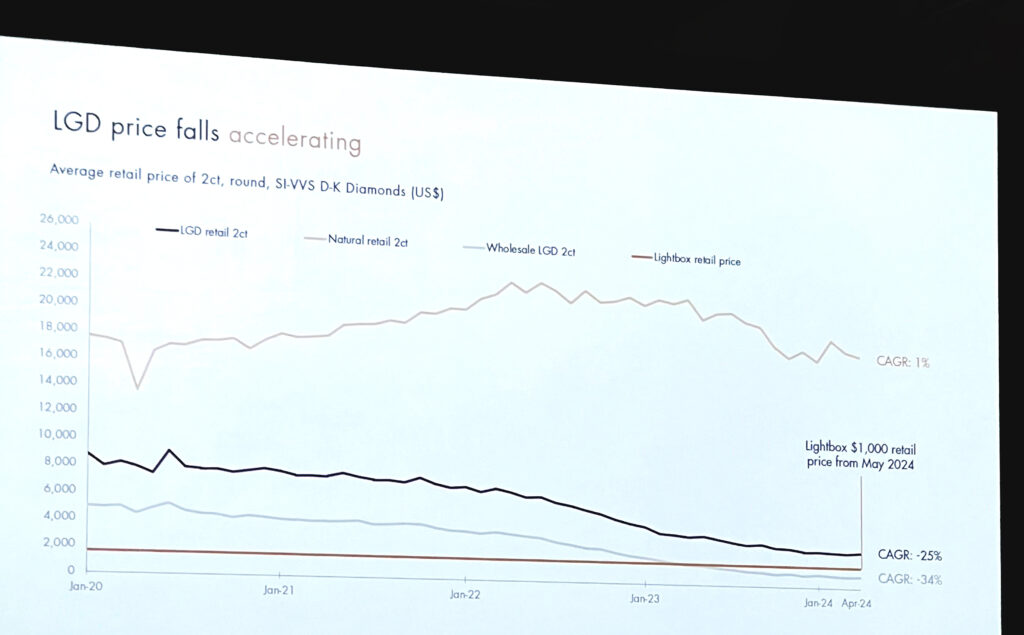

LGD’s impact on natural diamond demand will fade away, says Cook. Pointing to the numbers, Cook presents a chart that displays the retail price of a two carat natural diamond, despite the much discussed sector challenges – along with skepticism in the room, saw a 1% CAGR (Compound Annual Growth Rate).” [Interesting math – see the chart below.]

What Cook was really wanting to get at was this… “The retail price of an equivalent two carat LGD over the same period saw a 25% annual decline in price! The wholesale price of that two carat LGD fell even faster, at 34% per year.

Cook used this opportunity to boast about Lightbox, the De Beers retail outlet that sells LGD-set jewelry. “We’re proud that Lightbox has led the way in transparent, honest prices for LGDs. Retail prices in the wider sector are now trending down towards this level. And we strongly believe LGD jewelry will move towards a ‘production cost, plus margin’ retail model. If that happens, ladies and gentlemen, LGD prices could fall to $100 per carat.”

Prices Drop Causing a Bifurcation

Cook also pointed out that, on average, LGD inventories are held for about 100 days. This holding period, in a declining price environment, in an industry where inventory is so important, causes the drops in LGD prices to be particularly painful. “And in fact,” says Cook, “earlier this month, we at Lightbox reduced our prices of our LGDs by over a third in response to the evolving sector dynamics.” Llightbox is selling at retail from $500/carat.

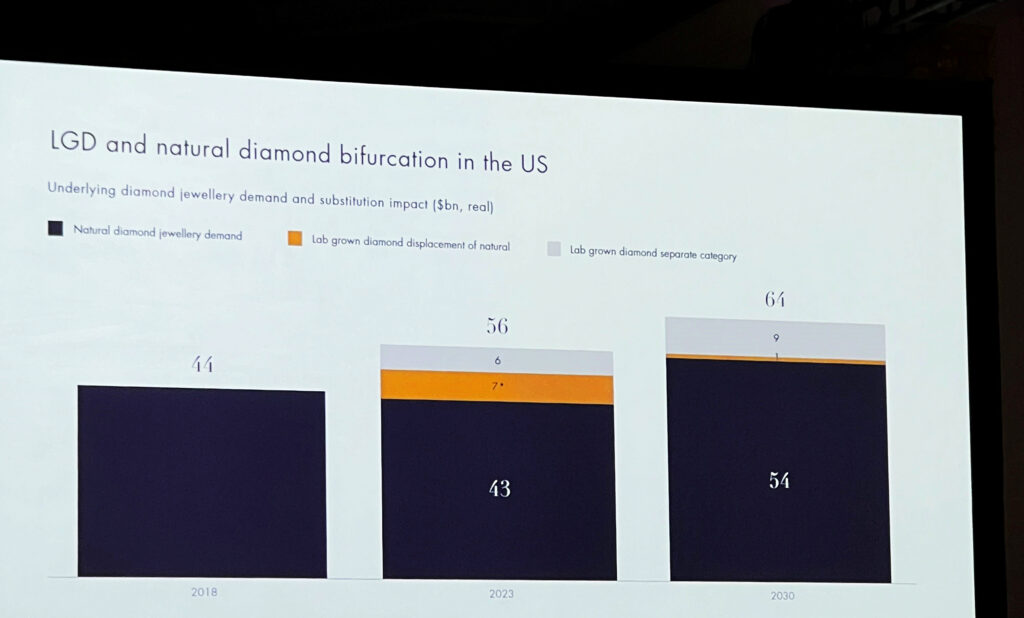

What Cook wanted us to understand, more importantly, is that price drops are driving a bifurcation, a split between natural diamonds and LGDs. “As the two product categories increasingly reside in different price brackets, they see less direct competition,” says Cook. “Look at lab grown rubies, emeralds, and sapphires. They’ve all been through the same evolution process that we’re now seeing with LGDs.” Cook noted that lab grown color competes with fashion jewelry, rather than with their natural counterparts. “Meanwhile, consumers buy natural diamonds as valuable symbols of their most valuable moments in life.”

“As LGD prices continue to plunge,” says Cook, “customers will increasingly recognize that they do not have the same attributes as natural diamonds. They are not finite. They are not unique, and they are not rare.”

Cook now feels confident that as consumers see the price differential between lab grown diamonds and natural diamonds continuing to widen, the remaining LGD demand impact from natural diamonds will dissipate. “By the end of this decade, we expect 90% of LGD sales won’t compete directly with natural diamonds.”

The Finale

“Oh, and We’re Leaving the Synthetic Diamond Jewelry Business”

Cook is wrapping things up, talking about LGDs. “We believe that the price differential between natural diamonds and LGDs will grow and grow and grow and grow. So, we will ramp up our production of our new retail customer facing detection technology, Diamond Proof, so that everyone, everywhere can tell the difference.” Diamond Proof is this toaster-sized sales-counter LGD detector (priced at just over USD$10,000). De Beers believes a counter tool such as this will become standard operating equipment for the retail jeweler. [Something tells us that Signet will probably invest heavily in such a device while they work with De Beers to focus on natural mined diamonds.]

And then, even after talking about how well Lightbox has performed, Cook announces that De Beers will no longer be in the synthetic diamond jewelry business! “We believe that the value of Lab Grown Diamonds lies in technology rather than in jewelry. So, De Beers will suspend production of lab grown diamonds for jewelry, and instead, we will evolve Element Six so it’s not just a leader in producing synthetic diamonds, but it becomes THE leader in synthetic diamond technology solutions. This starts with concentrating all our resources in a single world class CVD hub here in the United States, in Portland, Oregon.”

AH! So, De Beers brought down the price of LGDs by getting into the synthetic diamond jewelry market (Lightbox), and now that prices have fallen even farther below where De Beers thought they might end up, they no longer need to be in the business. Well, now that is interesting!

“Thank You for Coming”

Just one minute later, it was over. Many of the attendees walked out of the room wondering, “did he just say they are getting of the synthetic diamond jewelry business? What about Lightbox?”

Great question. We found out later that Lightbox has plenty of inventory, so they’re not going away just yet.

What’s Happening with the Sale?

And what about Anglo American?

Just so you know, Cook and his team did not once mention the 10,000 pound Gorilla in the room – the sale of De Beers by Anglo American.

That’s another conversation for another time.

You can watch the entire morning’s presentation, in this YouTube video clip here!